Don't forget to complete Transport for London forms!

LONDON CONGESTION CHARGE

The Congestion Charge is a £15 daily charge if you drive within the Congestion Charge zone between 07:00-22:00 Monday to Friday and 12:00-18:00 on Saturday, Sunday and bank holidays. There is no charge on Christmas Day (25 December) and New Year's Day bank holiday.

Does the Congestion Charge apply to my veteran vehicle and tender vehicle?

ALL vehicles, regardless of age and whether they are registered in the UK or overseas must pay this charge. However, if your veteran vehicle is being towed on a trailer, then only the towing vehicle is subject to Congestion Charge. Once your veteran car is unloaded and driven on the road the charge will also apply to that,

Paying the Congestion Charge: You pay this via the Transport for London website (either with a TfL London Road User Charging account or direct payment on the site).

ULEZ

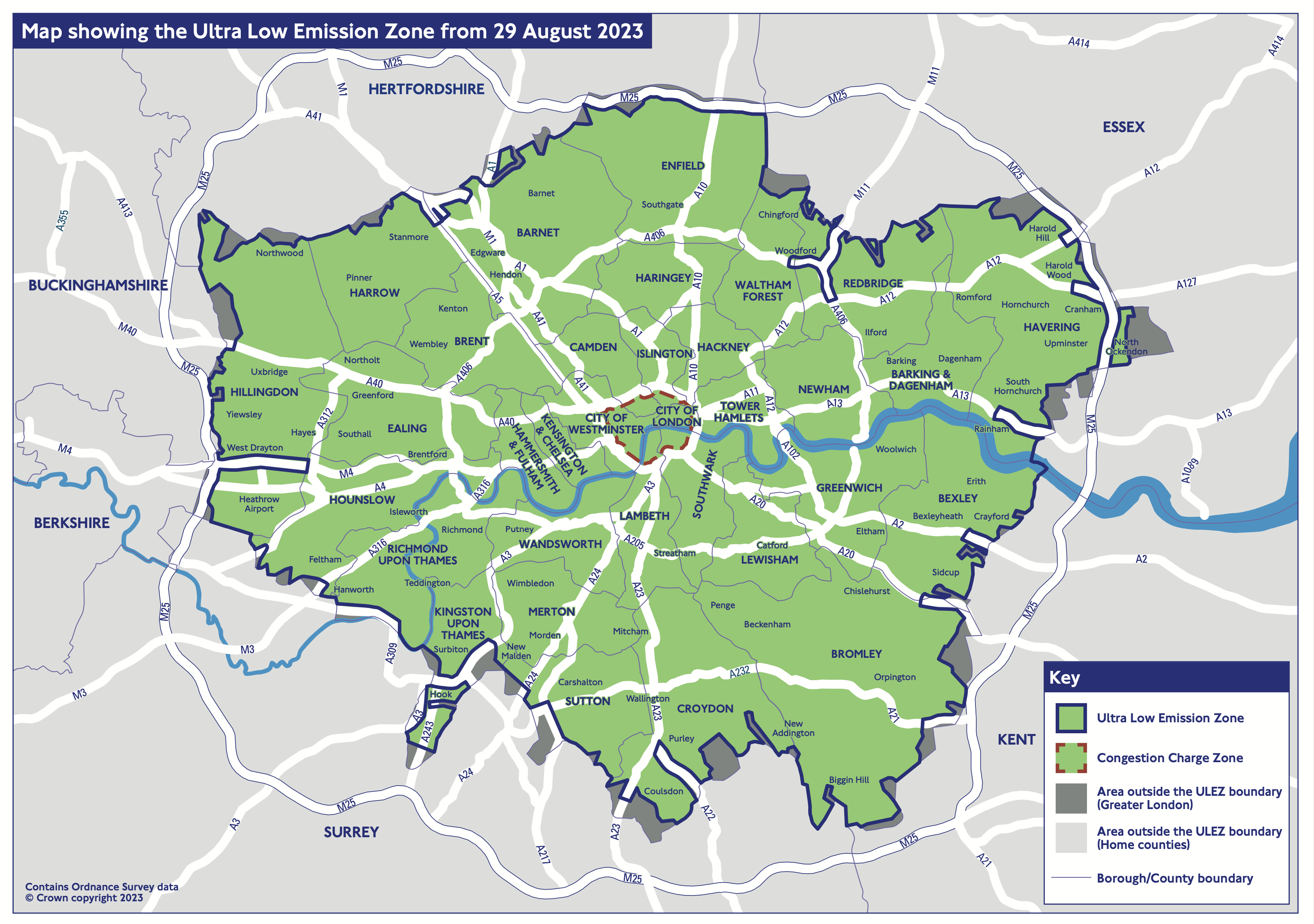

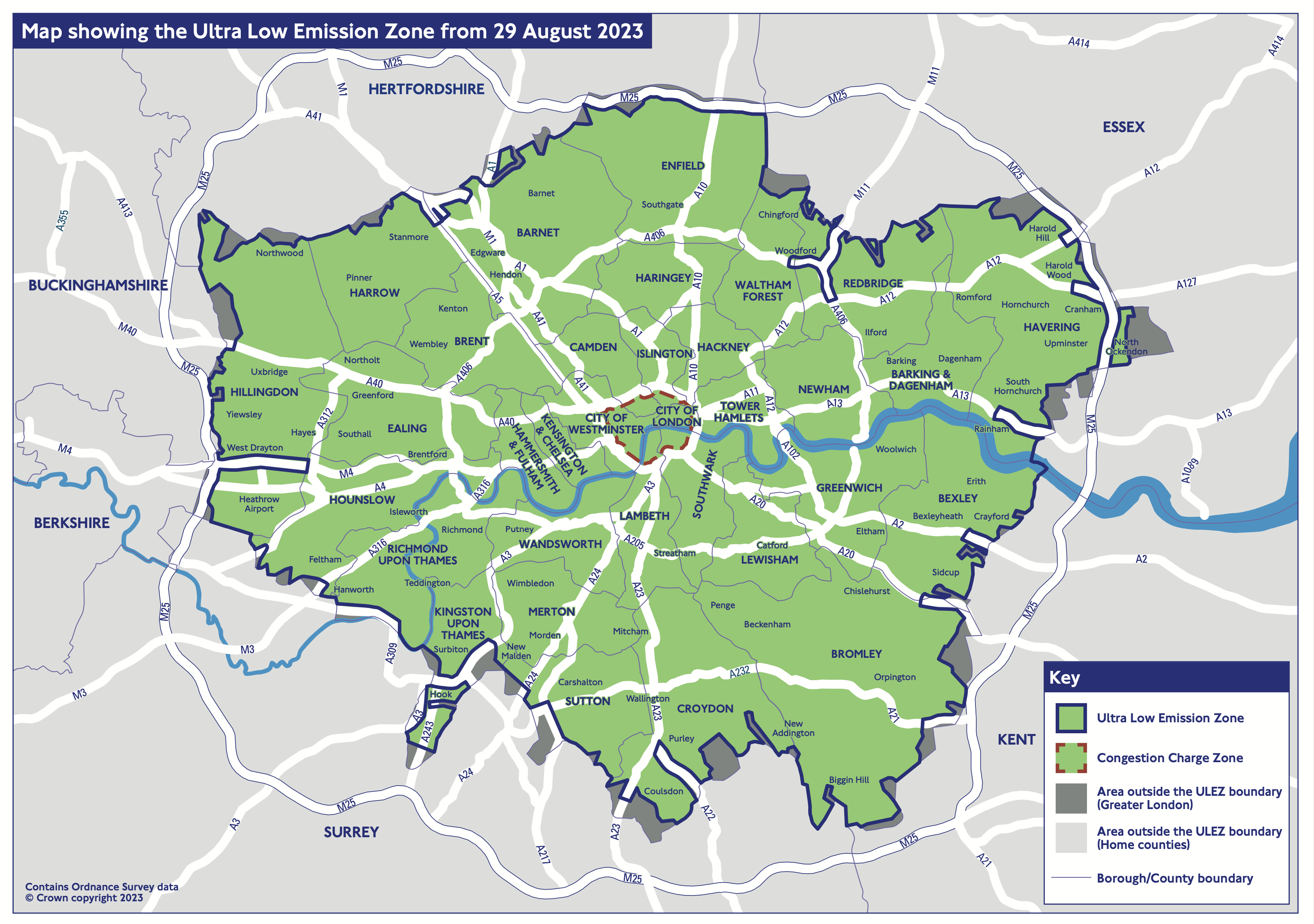

The Ultra Low Emission Zone (ULEZ) operates 24 hours a day, 7 days a week, every day of the year, except Christmas Day (25 December). The zone operates across all London boroughs, and does not include the M25. If your vehicle doesn't meet the ULEZ emissions standards and isn't exempt, you need to pay a £12.50 daily charge to drive within the zone.

Click here to view and download the latest ULEZ zone map as a PDF.

Does ULEZ apply to my veteran vehicle and tender vehicle, even though they are registered outside the UK?

ULEZ will apply to your road car and trailer while you are towing your veteran car through London and, once your veteran car is unloaded and driven on the road it will also apply to that, as it is then viewed as a separate vehicle.

However, veteran vehicles are exempt from paying the charge, provided it is registered with ULEZ and tender vehicles may also be exempt, depending on their size and emissions - see details below.

Owners of veteran vehicles registered outside of the UK will need to set up an account with Transport for London, then register that veteran vehicle for exemption from the ULEZ tax. You can find details of how to do this in our 'Driving in London' guides (see below).

CLICK HERE TO DOWNLOAD THE GUIDE IN ENGLISH

DOWNLOAD BOVENSTAANDE INFORMATIE ALS PDF

TÉLÉCHARGER LES INFORMATIONS CI-DESSUS AU FORMAT PDF

LADEN SIE DIESE INFORMATIONEN AUF DEUTSCH HERUNTER

Tender vehicles registered overseas are also subject to ULEZ if their emissions do not fall within the acceptable levels. You can check modern overseas vehicle registrations on the TfL website - and if you need to pay ULEZ on your tender vehicle, you will be told how to do so.

.png)

.resize-500x189.png)